lubertsi-beeline.online Overview

Overview

Interest Rate With Fha Loan

On Tuesday, September 10, , the average APR on a year fixed-rate mortgage remained at %. The average APR on a year fixed-rate mortgage remained. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Your lender will incorporate it into your monthly mortgage payment. Amounts for this insurance range from % to % of the loan balance on a year FHA. The interest rate is set by the lender and determined according to your credit history, size of down payment, and the housing market values. When it comes to. An FHA loan can only be used to finance your primary residence, which is the home where you live most of the time. FHA loans cannot be used for second homes. FHA loan interest rates can be more competitive than conventional mortgages but will vary depending upon the “Key Factors” listed above. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. On a $, mortgage, you. Graph and download economic data for Year Fixed Rate FHA Mortgage Index (OBMMIFHA30YF) from to about FHA, year, fixed, mortgage. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate. On Tuesday, September 10, , the average APR on a year fixed-rate mortgage remained at %. The average APR on a year fixed-rate mortgage remained. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Your lender will incorporate it into your monthly mortgage payment. Amounts for this insurance range from % to % of the loan balance on a year FHA. The interest rate is set by the lender and determined according to your credit history, size of down payment, and the housing market values. When it comes to. An FHA loan can only be used to finance your primary residence, which is the home where you live most of the time. FHA loans cannot be used for second homes. FHA loan interest rates can be more competitive than conventional mortgages but will vary depending upon the “Key Factors” listed above. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. On a $, mortgage, you. Graph and download economic data for Year Fixed Rate FHA Mortgage Index (OBMMIFHA30YF) from to about FHA, year, fixed, mortgage. Additionally, the current national average year fixed FHA mortgage rate remained stable at %. The current national average 5-year ARM FHA mortgage rate.

As of September 8, , the average FHA mortgage APR is %. Terms Explained. 0.

Yes! When you refinance your home, you actually pay off your existing mortgage and replace it with a new one. You might do this to get a lower interest rate or. FHA loans feature low down payment and more flexible guidelines. See requirements & rates and find an FHA mortgage that meets your needs at lubertsi-beeline.online An FHA mortgage requires an annual mortgage insurance premium in the range of to percent and a mortgage insurance premium paid upfront of percent. As of September 9, , a year fixed FHA loan rate in Utah is %(%APR). Use the tool below to customize Utah FHA loan rates for year. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. A Federal Housing Administration (FHA) loan is a home mortgage that is insured by the government and issued by a bank or other lender approved by the agency. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for. For most of early , FHA mortgage rates have been near 7 percent. The table below brings together a comprehensive national survey of mortgage lenders to help. Today's current FHA loan mortgage rates. See your personalized rates for a FHA mortgage by providing answers to a few questions below. Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. Today's FHA Loan Rates ; % · % · Year Fixed · %. FHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo SmartONE+ By Rocket Interest rate is the percentage you pay to borrow money for a home loan. Choose an FHA Loan that gives you more. A PenFed FHA Loan provides a great interest rate along with money-saving benefits before, while, and long after you buy. Current FHA mortgage rates. Average year FHA interest rates were around % in August, according to Zillow data — over a full percentage point below the. The year fixed rate mortgage had an average price of %. The average FHA (b) loan was a tenth of a percent higher, at %. To qualify for a Year FHA Loan, you'll need to make a down payment of at least percent of the total loan amount. The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. *The cases are calculated without the Hecm Loan numbers. Endorsement Fiscal Year. Endorsement Month. 1. 2. 3. 4. 5. 6. 7. 8. 9. Total. FHA mortgage rates for today, September 9, ; year fixed FHA, %, %, +

Definitionof Risk

Risk is the potential for harm. It is a prediction of a probable outcome based on evidence from previous experience. The nature of risk and harm can vary in. Risk management is the identification, evaluation, and prioritization of risks followed by coordinated and economical application of resources to minimize. A measure of the extent to which an entity is threatened by a potential circumstance or event, and typically a function of: (i) the adverse impacts that. risk in American English · 1. exposure to the chance of injury or loss; a hazard or dangerous chance. It's not worth the risk · 2. Insurance. a. the hazard or. A risk is an effect of uncertainty on an objective, with the effect having a positive or negative deviation from what is expected. A control is a set of. Consequences, you will recall, can be positive or negative. If the deviation from what was expected is negative, we have the popular notion of risk. “Risk”. Risk is defined as the possibility of a hazard actually causing harm. Companies use various techniques to identify risks and eliminate or mitigate them. graphic showing that risk is assessed as a function of consequences, vulnerabilities, and threats. Definition: Risk implies future uncertainty about deviation from expected earnings or expected outcome. Risk measures the uncertainty that an investor is. Risk is the potential for harm. It is a prediction of a probable outcome based on evidence from previous experience. The nature of risk and harm can vary in. Risk management is the identification, evaluation, and prioritization of risks followed by coordinated and economical application of resources to minimize. A measure of the extent to which an entity is threatened by a potential circumstance or event, and typically a function of: (i) the adverse impacts that. risk in American English · 1. exposure to the chance of injury or loss; a hazard or dangerous chance. It's not worth the risk · 2. Insurance. a. the hazard or. A risk is an effect of uncertainty on an objective, with the effect having a positive or negative deviation from what is expected. A control is a set of. Consequences, you will recall, can be positive or negative. If the deviation from what was expected is negative, we have the popular notion of risk. “Risk”. Risk is defined as the possibility of a hazard actually causing harm. Companies use various techniques to identify risks and eliminate or mitigate them. graphic showing that risk is assessed as a function of consequences, vulnerabilities, and threats. Definition: Risk implies future uncertainty about deviation from expected earnings or expected outcome. Risk measures the uncertainty that an investor is.

The Oxford English Dictionary defines risk as "chance or possibility of danger, loss, injury, etc.”. In the context of an infrastructure project, there are also. risk in American English · 1. exposure to the chance of injury or loss; a hazard or dangerous chance. It's not worth the risk · 2. Insurance. a. the hazard or. As per ISO , risk is "The effect of uncertainty on objectives" whereas risk management is "coordinated activities to direct and control and organization. verb · to expose to danger or loss; hazard · to act in spite of the possibility of (injury or loss). to risk a fall in climbing. Risk is a combination of the likelihood of a vulnerability or threat occurring and if so, the magnitude of the negative impact on the organization (people. Risk is subjective and socially constructed. Risk is a problem, a threat, a source of insecurity. Risk is a pleasure, a thrill, a source of profit and freedom. In the financial world, risk refers to the chance that an investment's actual return will differ from what is expected—the possibility that an investment won't. A risk assessment usually involves incomplete data, scientific uncertainty, and the need for expert judgment. The pressure to narrow the scope becomes a. Main navigation Risk level: The risk level can be low, moderate or high. Each enterprise risk has a risk level based on the impact and likelihood ranking of. RISK meaning: 1. the possibility of something bad happening: 2. something bad that might happen: 3. in a. Learn more. In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. In general, as investment risks rise. RISK meaning: 1: the possibility that something bad or unpleasant (such as an injury or a loss) will happen; 2: someone or something that may cause. The below definitions exclude issues such as weather/natural disasters and power outage concerns, which will be captured separately. High Risk: An identified. Types of Risk · Systematic Risk – The overall impact of the market · Unsystematic Risk – Asset-specific or company-specific uncertainty · Political/Regulatory. The PMBOK® Guide describes risk as, An uncertain event or condition, that if it occurs, has a positive or negative effect on a project's objective. The key. Concept of Risk. According to the International Organisation for Standardization (ISO), the risk would be defined as a "combination of the probability of an. avoid (risk): reduce or eliminate a risk event or condition by taking an alternate path. (issue): eliminate the consequence of the event or condition by taking. What Are the 4 Main Types of Business Risk? The four main types of risk that businesses encounter are strategic, compliance (regulatory), operational, and. PDF | Risk is the foundation of insurance but a brief survey of insurance text books reveals differences of opinion among authors concerning the.

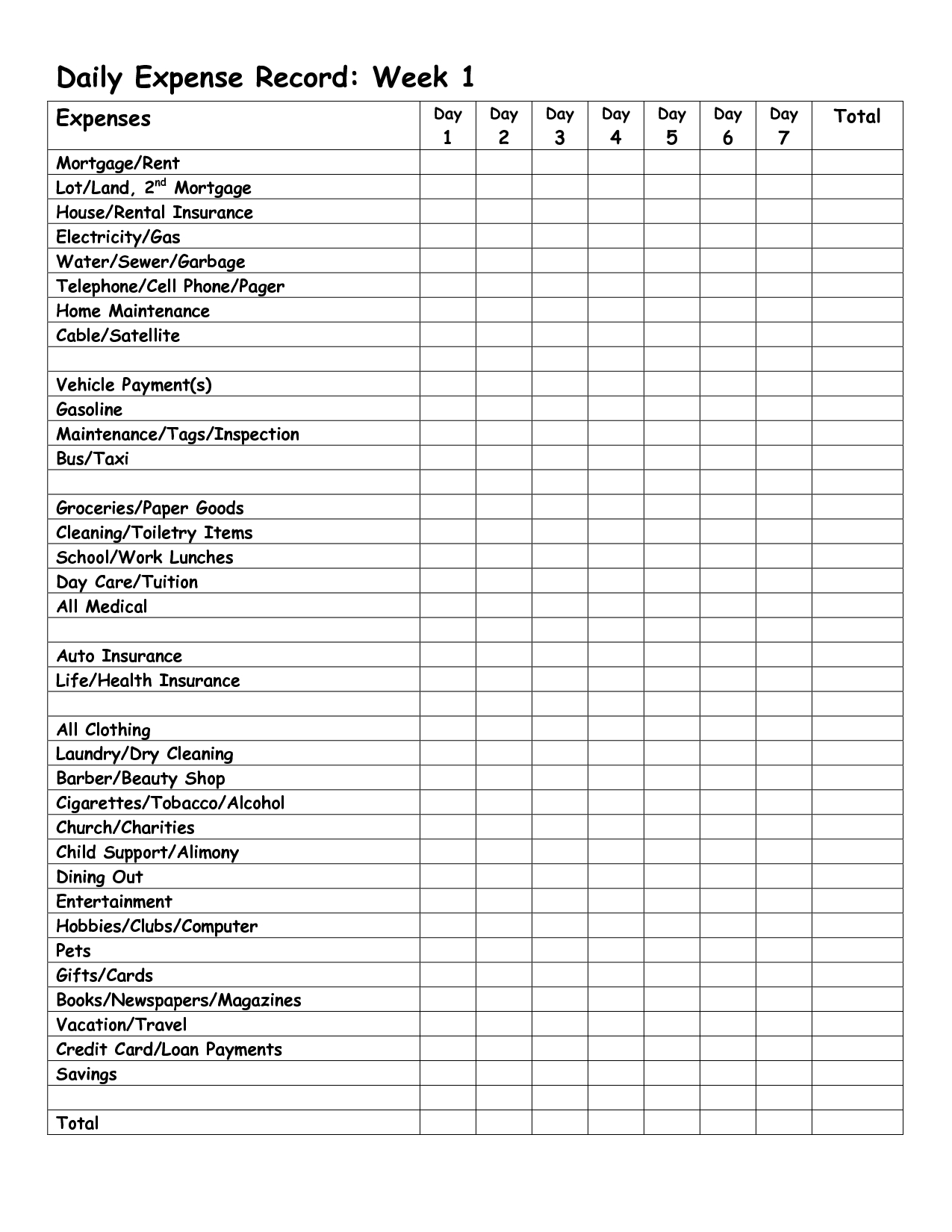

List Of Office Expenses

Office expenses are costs related to the operation of your business. These include items such as web site services, computer software, domain names, merchant. Union dues, agency fees or initiation fees. Review the General Guidelines for Unreimbursed Expense Documentation for a complete list. The actual expense must be. Travel, Gift, and Car Expenses · Charitable Contributions · Miscellaneous Deductions · How To Depreciate Property · Tax Benefits for Education · Standard mileage. Common business expense categories · Payroll · Benefits · Rent & utilities · Marketing & advertising · Office supplies · Meals & entertainment · Travel · Business. Office Expenses. Items that enhance your office environment, like décor, music subscriptions, or snacks, are considered office expenses. Payroll Expenses. Generally, the cost of materials and supplies used in the course of a trade or business may be deducted as a business expense in the tax year they are used. General office expenses, such as the cost of paper, print ink, pens, and other office supplies. The cost of training courses for employees. Common business expense categories list · Rent · Utilities · Office Expenses · Office Supplies · Advertising and Marketing · SaaS Subscriptions · Training and. Rent or mortgage payments. · Home office costs. · Utilities. · Furniture, equipment, and machinery. · Office supplies. · Advertising and marketing. · Website and. Office expenses are costs related to the operation of your business. These include items such as web site services, computer software, domain names, merchant. Union dues, agency fees or initiation fees. Review the General Guidelines for Unreimbursed Expense Documentation for a complete list. The actual expense must be. Travel, Gift, and Car Expenses · Charitable Contributions · Miscellaneous Deductions · How To Depreciate Property · Tax Benefits for Education · Standard mileage. Common business expense categories · Payroll · Benefits · Rent & utilities · Marketing & advertising · Office supplies · Meals & entertainment · Travel · Business. Office Expenses. Items that enhance your office environment, like décor, music subscriptions, or snacks, are considered office expenses. Payroll Expenses. Generally, the cost of materials and supplies used in the course of a trade or business may be deducted as a business expense in the tax year they are used. General office expenses, such as the cost of paper, print ink, pens, and other office supplies. The cost of training courses for employees. Common business expense categories list · Rent · Utilities · Office Expenses · Office Supplies · Advertising and Marketing · SaaS Subscriptions · Training and. Rent or mortgage payments. · Home office costs. · Utilities. · Furniture, equipment, and machinery. · Office supplies. · Advertising and marketing. · Website and.

Some of these items that are included in the accounting are: paper, pens, pencils, desk supplies, light bulbs, office forms, toner or printer cartridges, and. Office supplies are tax deductible for self-employed individuals and can be reported under the office expenses category on Schedule C. Business expense examples include inventory purchases, payroll, salaries and office rent. Business expenses fall into one of two categories. 1. Auto Expenses If you use your car for business or your business owns its own vehicle, you can deduct some of the costs of keeping it on the road. Mastering. What Are Examples of Business Expenses? · 1. Business Meals · 2. Work-related Travel Fees · 3. Work-related Car Use · 4. Business Insurance · 5. Home Office. Examples of office expenses may include the internet bill, phone lines, utilities, cost of stationery, taxes, etc. Home Office Expense. Summary. A home office. 1. The qualified business income deduction · 2. Home office expenses · 3. Phone and internet costs · 4. Salaries, benefits, and contractors · 5. Interest on. Health insurance · Home office deduction · Retirement plans · First year expense deduction · Rent, phones, utilities · Auto expenses · Education · Entertainment. For example, if you pay for painting or repairs only in the area used for business, this would be a direct expense. Indirect Expenses are those expenses that. Thank you for downloading! · 1. Employee wages: · 2. Employee education expenses: · 3. Employee benefits: · 4. Rent or lease payments: · 5. Taxes for leased. Some of the small business expense categories are 1. Payroll 2. Mortgage payments 3. Software subscriptions 3. Advertising and marketing. Some common items in a business expense categories list include office supplies, rent, salaries and wages, advertising and social media campaigns, business. What Are Office Expenses for Tax Deduction? · Supplies · Rent or Mortgage Interest · Utilities · Office Furniture · Computers and Software · Tax Deductions for. The main deductible categories are direct expenses, indirect expenses, and interest on debt. Non-deductible expenses include bribes, kickbacks, fines, and. Additional Information – Common Business Deductions · Automobile Expenses · Business Start-up Costs · Home Office Expenses · Travel, Meals, and Entertainment. $ ______. Page 2. Business Expense List. 2. B. Automobile Expenses: 1. If you deduct actual expenses specify: • gasoline and oil. The business expenses list every business owner needs · Rent. Any space you rent to conduct business may be tax deductible. · Salaries. Categorize all salaries. Office furniture is categorized as "Office Equipment" or "Fixed Assets" under expenses. By nature, it's a capital expenditure, delivering lasting value to the. $5 per square foot standardized deduction. Note: You can't deduct unrelated business expenses such as first telephone line in home and lawn care. Fact-Checked · Rent or home office · Employees' wages and other compensation · Utilities · Advertising · Auto expenses · Travel expenses · Entertainment, including.

What Is A Take Out Mortgage

You pay interest-only during the construction phase. · You'll need money to live elsewhere while the home is built. · The loan converts to a permanent mortgage. closing cost credit, eligible buyers get up to $5, to apply toward one-time closing costs when buying a primary home. Learn more >. Relationship mortgage. A takeout loan is simply a permanent loan that pays off a construction loan. It's that simple. You build an office building with an uncovered construction loan. With a reverse mortgage, the amount of money you can borrow is based on how much equity you have in your home. (Your equity is how much money you could get for. How does a reverse mortgage affect property ownership? When homeowners take out a reverse mortgage, they retain the title to their home. This means they. Co-Borrower: Any individual who will assume responsibility on the loan, take a title interest in the property and intends to occupy the property as their. With an equity take-out mortgage, a homeowner can borrow money from a lender based on the equity they have in their home. This can be done by. Whether you're looking to get a home loan, refinance a mortgage or access your home's equity, we've got all the tools and resources you need to get started. An assumable mortgage involves one borrower taking over, or assuming, another borrower's existing home loan. Find out how it works. You pay interest-only during the construction phase. · You'll need money to live elsewhere while the home is built. · The loan converts to a permanent mortgage. closing cost credit, eligible buyers get up to $5, to apply toward one-time closing costs when buying a primary home. Learn more >. Relationship mortgage. A takeout loan is simply a permanent loan that pays off a construction loan. It's that simple. You build an office building with an uncovered construction loan. With a reverse mortgage, the amount of money you can borrow is based on how much equity you have in your home. (Your equity is how much money you could get for. How does a reverse mortgage affect property ownership? When homeowners take out a reverse mortgage, they retain the title to their home. This means they. Co-Borrower: Any individual who will assume responsibility on the loan, take a title interest in the property and intends to occupy the property as their. With an equity take-out mortgage, a homeowner can borrow money from a lender based on the equity they have in their home. This can be done by. Whether you're looking to get a home loan, refinance a mortgage or access your home's equity, we've got all the tools and resources you need to get started. An assumable mortgage involves one borrower taking over, or assuming, another borrower's existing home loan. Find out how it works.

After researching how to apply for a personal loan, Sue learns she can take one out through a bank or online lender. Once you pay off the entire loan, the property is completely yours. When you build up enough equity, you can use that to get a second mortgage on your property. An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home loan question. Finally, you take out a mortgage for the completed home. Types of Loans. Lot Loans. The first type of loan you will need unless you already own a piece of. An equity take out mortgage is a mortgage loan used to “take out” equity for other purposes. It may be used for repairs or renovations of the property, to use. When you take out a mortgage, your lender makes a lump sum payment to the seller of the house. With a construction loan, your lender disburses the money in. It's important to consider all of your options before you take out a loan. Here are factors you should put into consideration before taking a loan. A mortgage is a loan you get from a lender to finance a home purchase. When you take out a mortgage, you promise to repay the money you've borrowed at an. Instead, you pay the agreed-upon amount via a certified check or wire transfer to the seller. Take Out a Hard Money Loan. Not everyone has the money to buy a. Connect with us · Maximum income and loan amount limits apply. Fixed-rate mortgages (no cash out refinances), primary residences only. · Monthly Mortgage. A mortgage is made up of four parts: The principal amount, interest, taxes and insurance. Remember that any time you borrow a loan of any kind, you're expected. In some scenarios, the lender or a lending group provides both forms of mortgage financing and approves the builder, buyer or owner for both mortgage products. When you refinance you're basically renegotiating your existing mortgage agreement and accessing the equity you've built in your home. Get in touch with a. During the construction phase, loan rates are typically variable and you would pay interest on the amount that's been paid out to your general contractor. When. In the case of a mortgage, the collateral is the home you're buying. If you don't pay your mortgage, the mortgage company could take possession of your home. Take out a loan definition in English. Purchasing property for your business requires obtaining a commercial real estate loan. Down payments on commercial real estate loans are larger than those for. To get an SBA-backed loan: · Read on to see the kinds of loans available · Enter basic information about what you're looking for on Lender Match · Create an. This means that you only have to apply once to be approved and only have to pay one set of closing costs. Get Started. One-Time Close (OTC) Benefits. Back to. CSMC Mortgage logo. Site Under Construction.

Tesla Monthly Charging Cost

Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. monthly. £ £ View product. Ohme. ePod. Best for Energy Tariff How much does it cost to charge the Tesla Model 3 Standard Range Plus? On an. You can expect to spend between $36 and $53 each month to charge your Tesla at home, depending on the model you lubertsi-beeline.online falls in line with the average cost of. Your vehicle and Superchargers communicate to select the appropriate charging rate for your vehicle. Supercharging rates may vary due to battery charge. EV charging costs vs. fuel costs (US averages) ; Average miles driven per month. 1, miles. 1, miles ; Average fuel cost per gallon. —. $ per gallon. For home charging a simple formula is to multiply the battery capacity in kilowatt (kW) times the cost per kW hour. For example: A Tesla Model 3 Long Range. Simply plug in your vehicle between 10 PM and 6 AM and enjoy unlimited overnight, home charging for a low fixed monthly fee. A full charge for a Tesla typically ranges from $13 to $18, depending on the model. Most Tesla owners find that charging their vehicle's battery is more. A Model 3 would cost $ per day. For a Model X, this Tesla driver would spend $ a day to recharge. With a Model Y, the charging cost is $ At the. Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. monthly. £ £ View product. Ohme. ePod. Best for Energy Tariff How much does it cost to charge the Tesla Model 3 Standard Range Plus? On an. You can expect to spend between $36 and $53 each month to charge your Tesla at home, depending on the model you lubertsi-beeline.online falls in line with the average cost of. Your vehicle and Superchargers communicate to select the appropriate charging rate for your vehicle. Supercharging rates may vary due to battery charge. EV charging costs vs. fuel costs (US averages) ; Average miles driven per month. 1, miles. 1, miles ; Average fuel cost per gallon. —. $ per gallon. For home charging a simple formula is to multiply the battery capacity in kilowatt (kW) times the cost per kW hour. For example: A Tesla Model 3 Long Range. Simply plug in your vehicle between 10 PM and 6 AM and enjoy unlimited overnight, home charging for a low fixed monthly fee. A full charge for a Tesla typically ranges from $13 to $18, depending on the model. Most Tesla owners find that charging their vehicle's battery is more. A Model 3 would cost $ per day. For a Model X, this Tesla driver would spend $ a day to recharge. With a Model Y, the charging cost is $ At the.

At certain Supercharging locations, congestion fees will replace idle fees. A congestion fee is a fee you pay when a Supercharger site is busy, and your. Tap 'Charging.' Tap 'Membership.' Tap 'Join Now.' Once you sign up for a Supercharging Membership, a monthly membership fee will be charged to your designated. At certain Supercharging locations, congestion fees will replace idle fees. A congestion fee is a fee you pay when a Supercharger site is busy, and your. monthly. £ £ View product. Ohme. ePod. Best for Energy Tariff How much does it cost to charge the Tesla Model 3 Standard Range Plus? On an. My Tesla Model 3 cost me about $10 for a “full” charge, when charging at home. At a Supercharger, the cost could vary from $15+ to as much as. At this price, charging an electric car such as the Nissan LEAF with a kWh battery with a mile range would cost about $7 to fully charge. Meanwhile. Tesla home charger installation costs can vary between $ to $, depending on the installation requirements. There are three different chargers to charge. Charging a Tesla's cost depends on electricity rates, charging speed, and battery capacity. Typically, it ranges from $8 to $20 for a complete charge. charge point and the efficiency of the motor. Zapmap monitors the cost of charging on a monthly basis. Our charging Price Index shows the weighted average. Charging a Tesla Model Y with a charge point at home with a standard Economy 7 tariff, a total of 80% of its capacity will give the vehicle around miles of. ' View your vehicle's monthly or yearly charging history which includes the energy charged (in kWh) and estimated spending of your vehicle's charging cost. Tesla home charger vs. Tesla Supercharger: Which is cheaper? A bar graph comparing the $36 monthly at-home charging cost of a Tesla Model. And if I were to charge every day, that's an estimated cost of $ per month, and $ per year. But as I mentioned above, I pulled the actuals of my. The average monthly charging cost of a Tesla is $25 or $ This average monthly cost varies depending on how much you charge, how often you drive, your. At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. As we write this, EV owners typically pay no more than $ to charge their car on a public charger in Canada. Sell your car (the easy way). If you're. Tesla Model 3 monthly payment after tax fees insurance and clearance, Tesla Model Y EV charging guide Zapmap clearance, Tesla Charging Cost Calculator How Much. Tesla Charging Costs What You Need to Know GOBankingRates clearance, Tesla Offers 30 Monthly Home Charging Plan for People in Windy Texas clearance, Tesla Home. With a Model Y, the charging cost is $ At the time of writing, Tesla hadn't yet included the Cybertruck in this calculator. These estimates are based on. Using the U.S. household average of cents per kWh, charging an electric car at home would cost nearly $68 per month. Tesla offers four charging tiers.

Us Banks With No Monthly Fees

Pay $ or $0 monthly maintenance fees if you meet any of these requirements. · Average account balance of $1, or greater · Have an open qualifying U.S. Bank. Often included are a debit card with no ATM fees at other banks, free checks and money orders, and online bill pay. Many premium checking accounts also give you. Open a BMO Smart Advantage checking account and pay no monthly fee with eStatements. Apply online in 5 minutes or less to our most popular account! No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Get access to personal banking services including no monthly fee checking, high-yield savings, cash advances up to $ and more with Varo Bank. Canada and US dollar Savings Account at no cost. Unlimited Get no monthly Plan fee banking for one year and no-fee BMO Global Money. If you're looking for a simple checking account with basic features – and more importantly, no monthly maintenance fees – you have plenty of options available. Apply for an online checking account with no fee to open, no monthly fees, and no minimum balance requirements. Awarded Best Online Bank for no opening. Pay $ or $0 monthly maintenance fees. Waive fees in multiple ways. Access automated financial tools. Track your spending, set up account alerts and utilize. Pay $ or $0 monthly maintenance fees if you meet any of these requirements. · Average account balance of $1, or greater · Have an open qualifying U.S. Bank. Often included are a debit card with no ATM fees at other banks, free checks and money orders, and online bill pay. Many premium checking accounts also give you. Open a BMO Smart Advantage checking account and pay no monthly fee with eStatements. Apply online in 5 minutes or less to our most popular account! No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Get access to personal banking services including no monthly fee checking, high-yield savings, cash advances up to $ and more with Varo Bank. Canada and US dollar Savings Account at no cost. Unlimited Get no monthly Plan fee banking for one year and no-fee BMO Global Money. If you're looking for a simple checking account with basic features – and more importantly, no monthly maintenance fees – you have plenty of options available. Apply for an online checking account with no fee to open, no monthly fees, and no minimum balance requirements. Awarded Best Online Bank for no opening. Pay $ or $0 monthly maintenance fees. Waive fees in multiple ways. Access automated financial tools. Track your spending, set up account alerts and utilize.

In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover Bank service marks for Chase, Bank of America, Wells Fargo. Open a Checking account from Capital One, a fee free online checking account that offers interest with no minimums and no-fee checking. Even when no monthly maintenance charge applies, M&T checking, savings and money market accounts may be subject to other transaction and service fees. Navy Federal Debit Card with Zero Liability protection · No monthly service fee, with dividends credited monthly · 30,+ ATMs throughout the U.S. and Canada. $12 or $0 Monthly Service Fee How to avoid the feeOpens Overlay. Direct Deposits made into this account totaling $ or more. no monthly service charge; ATM fee refunds up to $5 per statement cycle when using non-Frost ATMs; No fees for cashier's checks, money orders and Frost. Loaded with Benefits. No Monthly Fees. Explore your online banking options with the Bluebird® AMEX® Prepaid Debit Card or Bluebird® Visa® Debit Card. Access Checking Checkless banking · $5 Monthly Service Fee waived for 3 months after account opening or with a Relationship Tier or each month the account has. bank with us. Essential Plus. Unlimited debit transactions and Interac e No transaction fees on 19 of our most popular banking features. $ RBC Signature No Limit Banking · $ / month with the Seniors Rebate · Unlimited debit transactions in Canada · Up to $48 credit card annual fee rebate. That's why Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Traditional banks charged $11 Billion in. Clear Access Banking meets the Bank On National Account Standards for safe and affordable bank accounts with no overdraft fees. woman sliding on a debit card. No fees on overdraft plans3; No overdraft charged on a first occurrence each year with Citizens Fee Relief™. Monthly Maintenance Fee. $ or $; Waive the. us based chequing account · Bank as much as you want and enjoy no monthly fee for unlimited transactions. · Ideal for frequent travellers who live, travel, shop. rates with the U.S. Personal Chequing account from RBC Royal Bank. Apply today Monthly fee waived for VIP Banking & Signature No Limit Banking accounts. Banking account and one Business Advantage Savings account can be included for no monthly fee Bank of America® Mobile app or Online Banking with no fees. Can. Bonus Interest Rate Offer | US Savings · Bonus Smart Interest6 on up to $, when you save $ or more a month. No monthly fee; $5 per transaction4. With no monthly service fees or overdraft fees, you'll have more money to invest. Travel with confidence. No foreign transaction fees. No fees on most everyday transactions. Secure Banking customers told us they save an average of more than $40 a month on fees after opening their account Ultimate Package, $/month – No monthly account fee by maintaining a Scotia U.S. Dollar Daily Interest Savings Account, U.S. $/month – Waived with a.

How Long Do You Wait To Refinance Your Car

Since securing your original auto loan likely required a “hard inquiry” into your credit, it's often recommended that you wait at least six months to a year. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. From a practical standpoint, you may need to wait at least two to three months to refinance a car loan after purchase. Waiting Too Long To Refinance. Owing more money on your loan than your car is worth is known as being "upside down" on your loan, and it is something you should. While you could refinance your car almost immediately after purchase, it's best to wait at least six months to a year to give your credit score time to recover. Refinancing your auto loan can lower your monthly payment and save you money long term Do you want to save money on your car loan? Refinancing your car could. Typically, there is no set waiting period for refinancing a car loan once you have received the car's title, which usually takes about days. · Early. How Long Should You Wait Before Refinancing Your Car Loan? That said, there is no minimum waiting period before you can refinance a car loan (though after. However, even if you have good credit, the best advice is to wait at least six months before refinancing your auto loan. That's because the process of getting. Since securing your original auto loan likely required a “hard inquiry” into your credit, it's often recommended that you wait at least six months to a year. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. From a practical standpoint, you may need to wait at least two to three months to refinance a car loan after purchase. Waiting Too Long To Refinance. Owing more money on your loan than your car is worth is known as being "upside down" on your loan, and it is something you should. While you could refinance your car almost immediately after purchase, it's best to wait at least six months to a year to give your credit score time to recover. Refinancing your auto loan can lower your monthly payment and save you money long term Do you want to save money on your car loan? Refinancing your car could. Typically, there is no set waiting period for refinancing a car loan once you have received the car's title, which usually takes about days. · Early. How Long Should You Wait Before Refinancing Your Car Loan? That said, there is no minimum waiting period before you can refinance a car loan (though after. However, even if you have good credit, the best advice is to wait at least six months before refinancing your auto loan. That's because the process of getting.

Should I refinance my car? Refinancing is only beneficial when your new auto loan is somehow superior to the old one. So, it may make sense to refinance if. Car was recently purchased. If you're thinking of refinancing your loan, consider waiting at least 6 months after the purchase of your vehicle. This allows your. It's best to refinance your car as early as possible. Most auto loans are amortized, meaning your interest is built into the payment. So, you wind up paying. Learn how you can refinance your car loan with a credit union and what the benefits are How long should I wait to refinance my car? plus sign icon. Opening a. You can refinance whenever you want; there is no mandatory waiting period. I've seen people refinance within 48 hours of purchase. So as a best practice, it's ideal to wait at least one year before refinancing but you should have at least two years left on your loan. Having a minimum of two. You should wait for your credit score to improve to refinance your car. In addition, refinancing is a good option if your interest rates are lower than when you. Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long. 4. There are 2+ years remaining on your current loan If there are more than 2 years of payments left to make on your loan and the terms you can secure for a. You'll want to wait about three months after your initial loan just to make sure the title has completely transferred properly. This option is best if you have. Auto refinance loan must be at least $5, Loan must be open for at least 60 days with first scheduled payment made to be eligible for the $, which will be. If this is the case, you can refinance your auto loan almost immediately. Keep in mind that you may have to wait a month or longer while your dealer and the. In general, you should have at least two years remaining on your loan to ensure you experience a significant financial savings from auto refinance. If your car lease is nearing its end and you want to keep the car, it could make sense to finance the vehicle at a lower rate. Check your vehicle contract to. If your car lease is nearing its end and you want to keep the car, it could make sense to finance the vehicle at a lower rate. Check your vehicle contract to. Wait at least days from getting your original loan to refinance. It typically takes this long for the title on your vehicle to transfer properly, a. When you refinance your auto loan, it can lead to loan terms more of time you must wait before applying for a new auto loan. So long as you have the. If you didn't get the deal you were looking for, there's technically no time limit that you have to wait to seek refinancing on your. When Should I Refinance My Car? You can refinance your auto loan anytime. The sooner you refinance, the more money you'll save. That being said, if you need. You can refinance your car loan as long as you meet certain requirements set by the refinancing lender. Lenders often have refinance requirements for a.

Can You Buy And Sell Crypto In The Same Day

You can purchase items that are available in primary sales (including 'drops') or secondary sales. Pay with a credit/debit card, your account balance. You can also do a “limit sell order”, which means that your trade can be automatically closed when your coin hits a certain higher price. If we used the above. Day trading is a short-term and high-risk strategy where crypto investors buy and sell cryptocurrencies on the same day to profit from rapid price swings. Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Cashing out to your bank account via SEPA transfer. Select the currency pair you'd like to trade. Decide which assets you want to trade, such as buying Bitcoin (BTC) with US Dollars or selling Ethereum (ETH) for. Crypto trading is offered for 24 hours everyday and your orders will be executed throughout the day. Trading Limits. Currently, an order (buy or sell) must not. Although you can trade cryptocurrencies at any time of day, the market is more active during typical work hours and less active early in the morning, at night. Depending on network traffic, your crypto should generally arrive within minutes. Web3 Wallet. In Exodus Web3 Wallet, click the Buy & Sell icon. Crypto day trading primarily involves buying and selling crypto assets within a single trading day. Know the best cryptos and strategies for day trading. You can purchase items that are available in primary sales (including 'drops') or secondary sales. Pay with a credit/debit card, your account balance. You can also do a “limit sell order”, which means that your trade can be automatically closed when your coin hits a certain higher price. If we used the above. Day trading is a short-term and high-risk strategy where crypto investors buy and sell cryptocurrencies on the same day to profit from rapid price swings. Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Cashing out to your bank account via SEPA transfer. Select the currency pair you'd like to trade. Decide which assets you want to trade, such as buying Bitcoin (BTC) with US Dollars or selling Ethereum (ETH) for. Crypto trading is offered for 24 hours everyday and your orders will be executed throughout the day. Trading Limits. Currently, an order (buy or sell) must not. Although you can trade cryptocurrencies at any time of day, the market is more active during typical work hours and less active early in the morning, at night. Depending on network traffic, your crypto should generally arrive within minutes. Web3 Wallet. In Exodus Web3 Wallet, click the Buy & Sell icon. Crypto day trading primarily involves buying and selling crypto assets within a single trading day. Know the best cryptos and strategies for day trading.

Unfortunately, no. You must buy and be very active with the purchase.

Crypto involves constant wash trading. Using BTC as a base currency means constantly buying and selling BTC. As every time you buy another coin using BTC you. Unlike our stock and ETF trading windows of four times a day, you can trade crypto at any time*. You can then use those funds to purchase stocks or ETF. Anyone can become a crypto day trader, but to be a successful crypto day trader, you'll need analytical skills, a strong understanding of trading patterns and. Through our partnership with Paxos, you can easily spot trade crypto on Paxos's itBit crypto exchange. Paxos' itBit crypto exchange provides advanced. You can trade crypto 24/7 with your Robinhood Crypto account, with some exceptions like scheduled maintenance. We periodically schedule maintenance windows that. crypto day trader tools for Kraken and let Coinrule trade for you Coinrule lets you buy and sell cryptocurrencies on Kraken, using its advanced trading bots. You'll still be able to buy or sell stocks and ETFs, but you won't be able to buy and sell the same security on the same day. Your ability to day trade crypto. We've teamed up with Bakkt Crypto Solutions, LLC to provide you with a fun and educational crypto trading experience. With Webull Pay, you can buy and sell. If you place a sell order be prepared for them to cancel it the same day. The price can hit your sell order number but unless the ask price hits your number, it. Can I buy and sell the same kind of cryptocurrency in a day? Buy and sell orders placed for execution during a single trade window for a specific coin will be. It is a form of active trading, in which traders have to watch the market throughout the day to buy and sell cryptocurrencies on the same day. You can purchase items that are available in primary sales (including 'drops') or secondary sales. Pay with a credit/debit card, your account balance, or with. Unlike stocks and ETFs, you can trade crypto 24 hours a day, 7 days a week. Holidays do not affect your ability to buy and sell crypto. You don't need to. Platforms/venues for buying bitcoin include digital wallet providers, centralized spot exchanges, OTC desks (private 'Over-The-Counter' exchange services used. How to sell crypto with BitPay BitPay's crypto marketplace aggregates offers from multiple off-ramp partners, ensuring you always get the best rate with no. Crypto trading involves buying and selling digital tokens with the goal of turning a profit. The idea is to buy the tokens at a low price and sell them at a. To be able to buy crypto instantly on the lubertsi-beeline.online Bitcoin Exchange, create an account and top-up your balance. You can register either an individual or a. Welcome to Bitget. We are one of the world's leading crypto exchanges and the most trusted crypto social trading platform. WITH BITGET, YOU CAN EARN. Trade the names you know, with a name you can trust. Buy and sell bitcoin, ethereum, and litecoin in the same app where you trade stocks—for as little as $1. Day trading refers to a trading strategy where an individual buys and sells (or sells and buys) the same security in a margin account on the same day in an.

Is Silver A Good Buy

It is the second most-consumed commodity after oil, and there is no substitute for silver. This metal therefore offers good investment prospects. Silver has. Purchasing physical silver may be a good way to diversify your assets to potentially protect you against fluctuations of the economy. Buying physical silver can. Silver has long been considered a reliable asset to help diversify your investment portfolio. Some investors choose silver to hedge their other holdings, while. Silver coins have long been popular among collectors and investors. One of the significant benefits of buying silver coins is their aesthetic appeal. Silver. Physical silver is a great addition to any investment portfolio and highly sought after by investors and collectors alike. Silver bullion bars and rounds. AbraSilver is an undervalued investment opportunity with an outstanding portfolio of Au, Ag, and Cu projects in Argentina. Silver is a good buy for and beyond. If we are committed to making the changes required, then we have to use silver. While the muted economic growth expected in may not propel industrial demand, silver's value as a store of wealth, bolstered by its use in many and varied. Try to pay the least above spot price you can, but silver is a great investment “in my opinion”. Do your own research. I started buying one. It is the second most-consumed commodity after oil, and there is no substitute for silver. This metal therefore offers good investment prospects. Silver has. Purchasing physical silver may be a good way to diversify your assets to potentially protect you against fluctuations of the economy. Buying physical silver can. Silver has long been considered a reliable asset to help diversify your investment portfolio. Some investors choose silver to hedge their other holdings, while. Silver coins have long been popular among collectors and investors. One of the significant benefits of buying silver coins is their aesthetic appeal. Silver. Physical silver is a great addition to any investment portfolio and highly sought after by investors and collectors alike. Silver bullion bars and rounds. AbraSilver is an undervalued investment opportunity with an outstanding portfolio of Au, Ag, and Cu projects in Argentina. Silver is a good buy for and beyond. If we are committed to making the changes required, then we have to use silver. While the muted economic growth expected in may not propel industrial demand, silver's value as a store of wealth, bolstered by its use in many and varied. Try to pay the least above spot price you can, but silver is a great investment “in my opinion”. Do your own research. I started buying one.

Many investors spend time deciding whether to buy gold or buy silver, however the savviest investors own both. Whereas gold could offer the ultimate. Much like gold, silver is prized as an investment option and is often used for coins, bars and jewellery. However, silver also has a multitude of unique. Investors buying small silver bars or coins usually have to arrange storage themselves, which may present a significant security risk if kept at home. For this. Buying silver online is a smarter, more reliable way to diversify your financial portfolio. Additionally, investing in physical silver and gold are the only. Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is. 1. Silvercorp Metals (NYSEMKT:SVM) Silvercorp Metals (NYSEMKT:SVM) is the top silver stock with a Zen Score of 48, which is 12 points higher than the silver. How Digital Silver Investment Work? ; Create Account. Fill in basic details like your name, age, contact details, etc. ; Enter Amount/Gram. Enter the amount/. When it comes to investing your money in different assets, you should consider silver as it offers good returns on investment. When you compare the price of. Many savvy Canadian investors use physical silver to grow and protect their investment portfolios. These investors often use precious metals such as silver. Silver has many modern uses, which makes it a desirable asset in multiple industries that include solar energy and electronics — and a popular commodity for. If you'd like to further diversify your portfolio, silver can be a good investment as part of a larger basket of commodities. A good rule of thumb is to. It is much more affordable for the average investor, and yet as a precious metal will help maintain your standard of living as good as gold. If you cannot. Silver coins are durable, relatively scarce, universally accepted, fungible, portable and cannot be debased, and are therefore suitable as a medium of exchange. Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4, years. A mixed gold and silver investment will give you the best of both worlds, with the dependability of gold and the flexibility of silver. As long as you buy only from reputable dealers, buying silver is one of the least risky [market moves] you can make,” according to Yahoo! Finance. Why Buy. Silver has been recognized as a currency and store of value for over 4, years. It offers many of the same benefits as gold and can be added to an Individual. Investors buying small silver bars or coins usually have to arrange storage themselves, which may present a significant security risk if kept at home. For this. ETFs are a very accessible and liquid way of selling the tangible good. Silver can often be instantly sold at market price. Two of the largest ETFs that own. 1. Silvercorp Metals (NYSEMKT:SVM) Silvercorp Metals (NYSEMKT:SVM) is the top silver stock with a Zen Score of 48, which is 12 points higher than the silver.

Emazing Lights Shark Tank

Brian Lim first stepped into the Shark Tank 2 years ago with Emazing Lights and blew the sharks out of the water. Robert Herjavec called him the most. "Brian Lim, the CEO of the EmazingGroup, serial entrepreneur and Ecommerce Expert. He was on season 6 of ABC's Shark Tank. Robert Herjavec said Brian was “one. Brian Lim looks to light up the Shark Tank with Emazing Lights, his wildly successful LED lighted glove company, in Shark Tank episode EDM hits Shark Tank with @EmazingLights lubertsi-beeline.online Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13, Lim accepted a deal from sharks Mark Cuban and. EmazingLights is pioneering the new Gloving Movement into a skillful expression of art, along with iHeartRaves, which provides wildly unique festival fashion. Light Shows from EmazingLight's Thursday Night Lights · · [TNL] [5/17/] Bubbles EmazingLights Shark Tank S6E22 Extended Teaser [lubertsi-beeline.online]. Simply browse an extensive selection of the best shark tank emazinglights and filter by best match or price to find one that suits you! You can also filter out. K Followers, Following, Posts - @emazinglights on Instagram: " #1 Leader in Gloving & Light Shows ⭐As seen on Shark Tank, VICE, BBC, HBO. Brian Lim first stepped into the Shark Tank 2 years ago with Emazing Lights and blew the sharks out of the water. Robert Herjavec called him the most. "Brian Lim, the CEO of the EmazingGroup, serial entrepreneur and Ecommerce Expert. He was on season 6 of ABC's Shark Tank. Robert Herjavec said Brian was “one. Brian Lim looks to light up the Shark Tank with Emazing Lights, his wildly successful LED lighted glove company, in Shark Tank episode EDM hits Shark Tank with @EmazingLights lubertsi-beeline.online Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13, Lim accepted a deal from sharks Mark Cuban and. EmazingLights is pioneering the new Gloving Movement into a skillful expression of art, along with iHeartRaves, which provides wildly unique festival fashion. Light Shows from EmazingLight's Thursday Night Lights · · [TNL] [5/17/] Bubbles EmazingLights Shark Tank S6E22 Extended Teaser [lubertsi-beeline.online]. Simply browse an extensive selection of the best shark tank emazinglights and filter by best match or price to find one that suits you! You can also filter out. K Followers, Following, Posts - @emazinglights on Instagram: " #1 Leader in Gloving & Light Shows ⭐As seen on Shark Tank, VICE, BBC, HBO.

Featured on ABC's Shark Tank!. · Package contains: (10) Microlights, (20) Batteries, Premuim LEDs, Diffusers, White Emazing Magic Stretch Gloves, and a. Hiring at the Emazing Group: By Brian Lim. Mar 20, Why 'Shark Tank' investor Robert Herjavec says this entrepreneur might be. Shop EmazingLights eLite Element V2 LED Glove Set Light Up Toy - As Seen on Shark Tank! online at a best price in Puerto Rico. B00WYERRXS. Shark Tank. Their failure had nothing to do with Shark Tank. It was I ordered 6 lights on emazing, all of them arrived broken. CEO/Founder of @EmazingLights / @iHeartRaves / @INTOTHEAM. Deal with Mark Cuban and Daymond John on Shark Tank. Featured: Vice, Entrepreneur, Inc Brian Lim looks to light up the Shark Tank with Emazing Lights, his wildly successful LED lighted glove company, in Shark Tank episode Brian Lim is one such entrepreneur. In , he pitched his product EmazingLights, which are gloves with LED lights in the fingertips that have become popular. Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13th, Lim accepted a deal from sharks Mark Cuban. Emazing Lights lands deal in shark tank #edm #underground #lights #sharktank. Emazing Lights Gloves Update | Shark Tank Season 6 The latest dance craze, according to Brian Lim, is called “gloving”, which is basically a dance show for. EmazingLights, which sells LED embedded gloves to light Lim's appearance on Shark Tank wasn't the first time EmazingLights crashed while on Adobe Commerce. Brian Lim is a serial entrepreneur who has bootstrapped 3 ecommerce businesses that include lubertsi-beeline.online, lubertsi-beeline.online, lubertsi-beeline.online, which. Emazing Lights founder Brian Lim enters reality competition series, 'Shark Tank'. by: Lizzie Renck Mar 11, pinterest. The gloving business has. CEO/Founder of EmazingLights / iHeartRaves / INTO THE AM. Deal with Mark Cuban and Daymond John on Shark Tank. Featured on Rolling Stone, Vice, Inc Lim is asking for an investment of $k and offering a 5% equity in his company. Key Takeaways: Emazing Lights on Shark Tank. Product: LED gloves for gloving. Light up the night with our selection of light toy products from EmazingLights. From LED gloves & accessories to poi. While supplies last. This channel was created to showcase the best in gloving and light shows. Gloving is a fusion of art and dance that must be seen in order to be understood. EmazingLights Emazing Lights Electro LED Light Up Glove Set - As Seen On Shark Tank - 1 Leader In Gloving & Light Shows Black Gloves Prices | Shop Deals. Emazing Group has empowered a lifestyle of self-expression one individual at a time with the iHeartRaves, EmazingLights and INTO THE AM brands since The Emazing Group - INTO THE AM / iHeartRaves / EmazingLights Magazine, Business Insider, CNBC, MTV, ABC's Shark Tank, LA Weekly, MSN, and more.